20

WWT Report and Financial Statements 2012/13

31 March 2013, an improvement on 2011/12 but still

reflecting difficult worldwide economic conditions, and

consequent increase in competitive pressures.

Over the year the number of WWT’s members decreased

by 1% compared with 31 March 2012. Total membership

income over the year was £5.3m representing 31% of

WWT’s total income. WWT has over 211,000 members

who provide valuable support for the charity’s work, and

we expect to continue to increase this total further over

the coming years. To this end, we have maintained

investment in the recruitment of new members outside

our wetland centres, spending £282k in the year. The

overall cost of membership services, including Waterlife

magazine and maintaining membership details, has

remained at the same level as last year.

Visitor numbers at centres in the year were down 10% in

total when compared like-for-like with the previous year,

with paying visitors decreasing by 19% against the prior

year and non-paying, including member visits, decreasing

by 5%. We continue to see weather as a major influence

on the levels of visitation at WWT’s centres, together

with the economic downturn. All visitors are encouraged

to pay the higher ‘Gift Aid’ price, which includes a 10%

donation. For visitors who are UK tax payers, this donation

enables us to recover the tax on the entire admission

fee, which during the year contributed £0.3m. The cost

of staffing the wetland centres’ admission areas and

marketing the centres, events and the charity in general

was £1.4m.

Investments

WWT’s investments are managed by UBS and are

managed in a segregated portfolio. This portfolio

undergoes regular review and screening to ensure as

far as possible that the investments are not in conflict

with WWT’s charitable objectives whilst at the same

time maintaining growth and income. As at 31 March

2013 the market value of WWT’s investments stood at

£9.0m, an increase of £0.6m compared with 12 months

previously. Management fees were £42k, increasing

relative to the size of the portfolio. Total income returns for

the year amounted to £246k.

In addition to its listed investments, WWT owns

investment properties at Martin Mere as a result of the

purchase of farm land to extend the reserve in 2011/12.

Net current assets

Net current assets totalled £3.0m at the end of the year

(2012: £3.5m). Cash has decreased due to strategic

capital investment, but levels remain good and whilst

much is held in higher interest accounts to maximise

interest, some has been kept back to pay for sums that

are committed to.

Pension

In common with many companies and charities, WWT’s

defined benefit pension scheme has reported a deficit

in recent years. Action has been taken to reduce the

liability, closing the scheme to new entrants in 1997 and

ceasing further accrual of future benefits in 2005. An

actuarial valuation is carried out every three years. The

latest, as at 31 March 2012, showed the scheme in

deficit by £3.6m. As a result the charity has agreed with

the Pension Trustees to make annual payments into the

scheme of £255k next year, rising to £275k in 2014/15

and continuing for a period of 20 years. Accounting

regulations require us to report on a pension scheme

valuation based on a different set of assumptions within

these accounts. This valuation shows a deficit of £2.4m

at 31 March 2013 compared with a deficit of £521k at the

end of 2011/12 due to changes in actuarial assumptions.

The increase in the pension deficit has had the biggest

impact on the size of overall reserves during the year.

Further details regarding the pension scheme can be

found in Note 27 to the financial statements.

Reserves

WWT has a number of restricted funds where the

donor restricts the purpose for which the fund can be

used. These total £20.3m as at 31 March 2013, of

which £16.1m relates to capital items, such as land

and buildings, purchased with restricted donations.

The remaining £4.2m is current assets for ongoing

and future projects.

WWT holds £1.8m in a permanent endowment fund.

The income earned is transferred to the general fund

each year, but the capital remains in place subject only

to fluctuations in the market value of the investment

portfolio within which it is held. Along with the rest of the

investments, this fund has seen an increase in value of

£121k for the year.

Unrestricted funds total £7.7m, as at 31 March 2013.

Unrestricted funds include the general fund and funds

designated for a specific purpose by Council.

The Council’s reserves policy includes setting aside

sufficient funds to cover the charity’s unrestricted

essential expenditure for a period of up to six months.

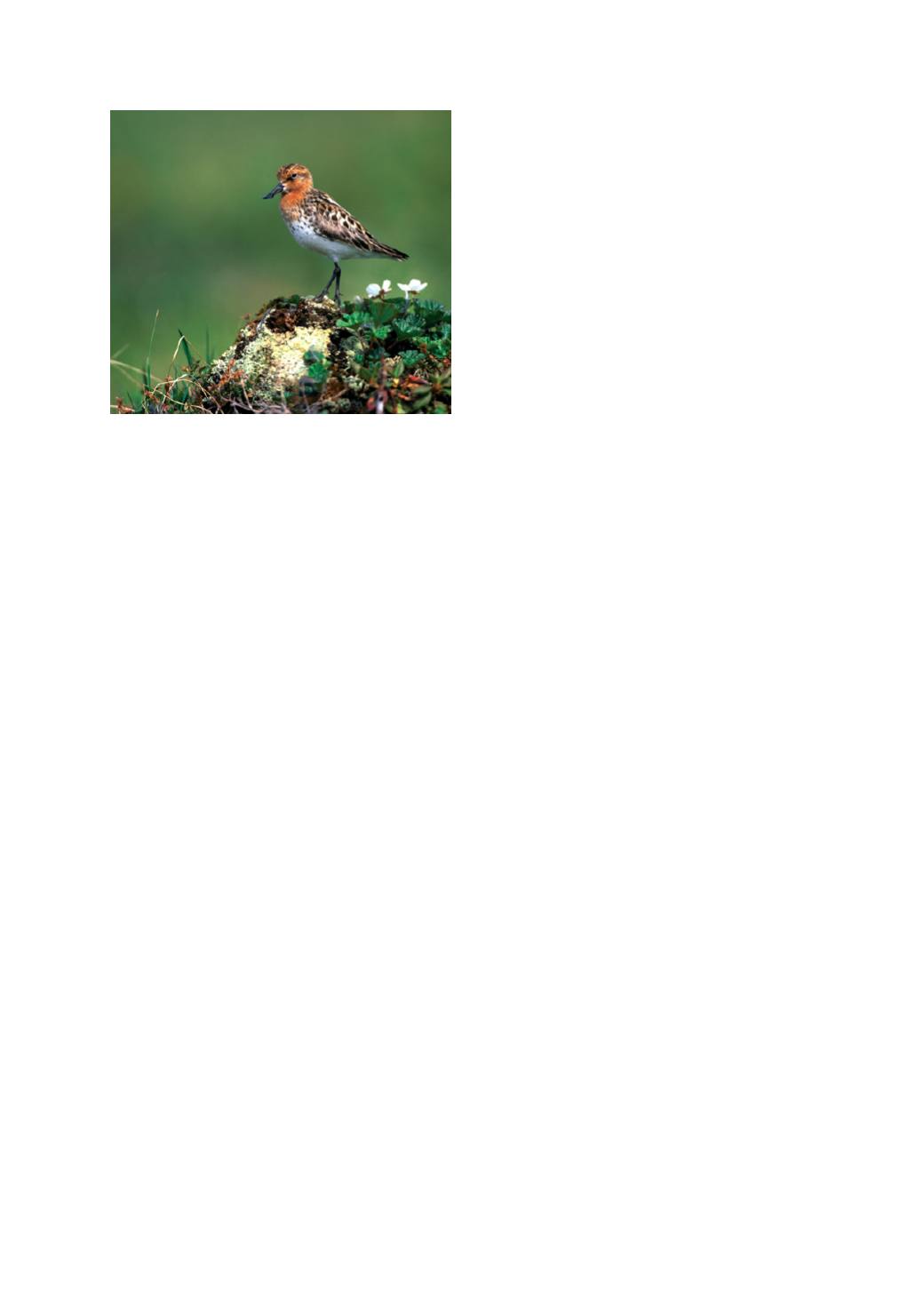

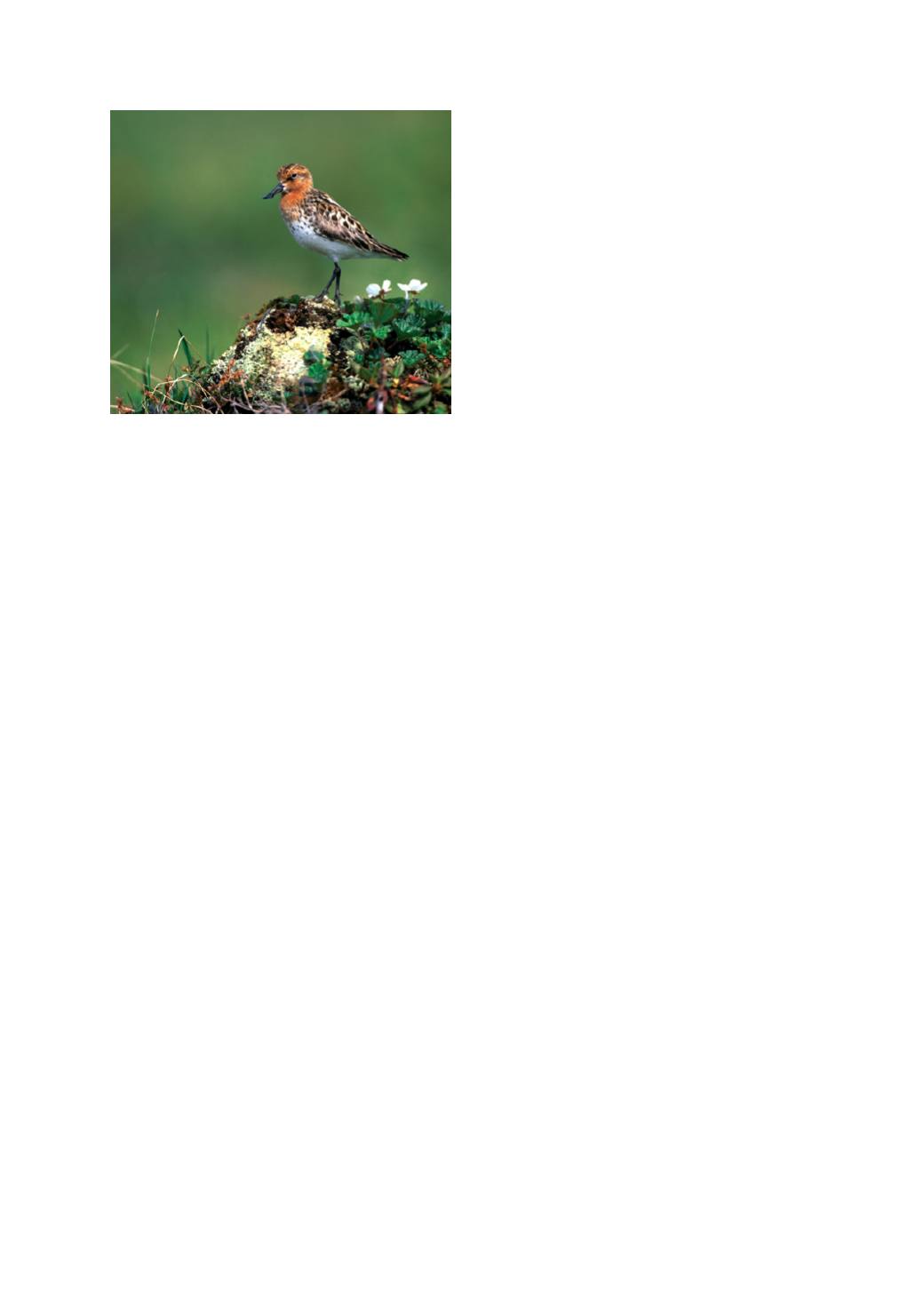

Photo: spoon-billed sandpiper, © Chris Schenk / FotoNatura