48

WWT Report and Financial Statements 2012/13

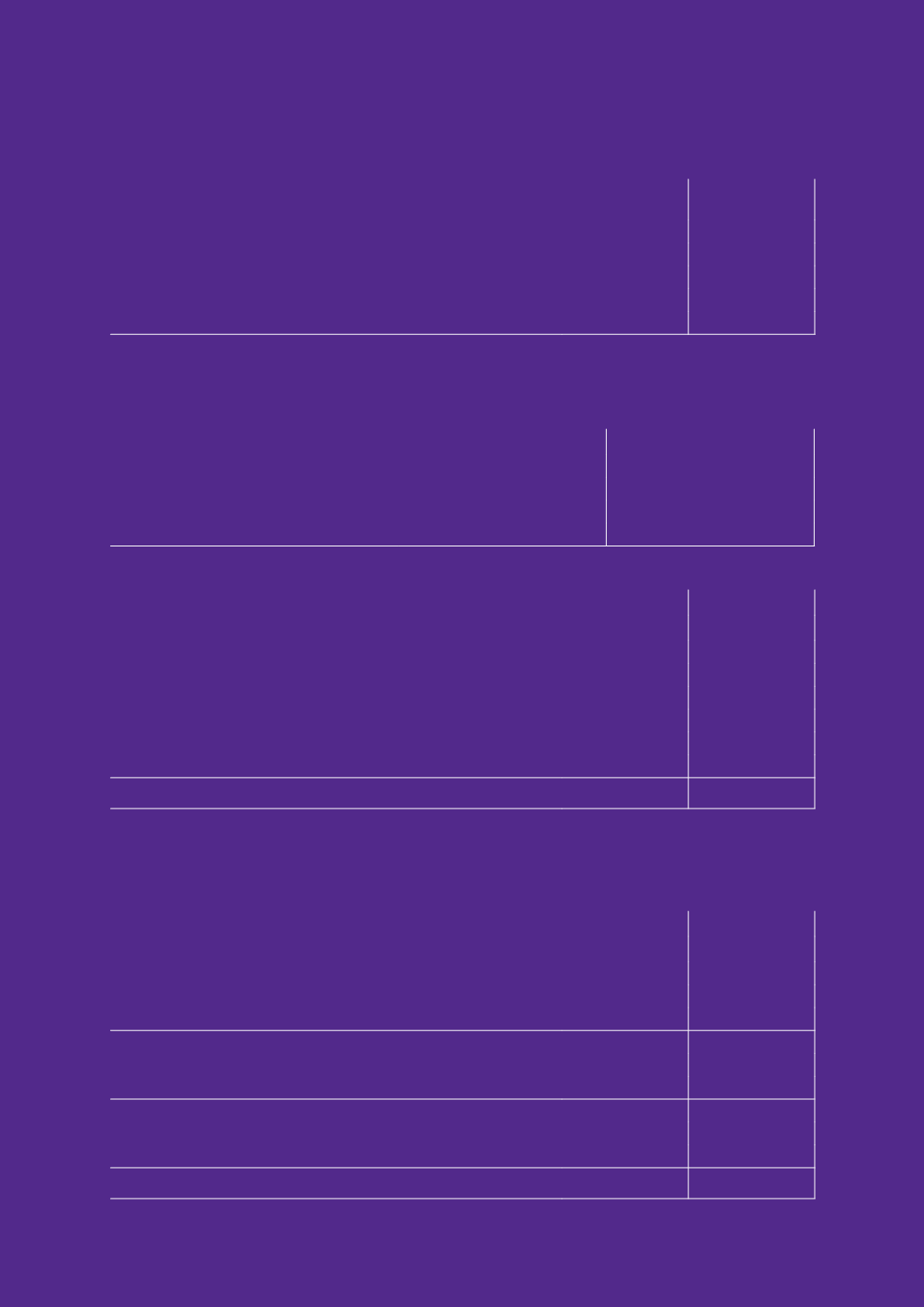

Expected rates of return on assets:

Other assumptions:

2013

% p.a.

2012

% p.a.

Bonds

2.8

3.7

Equities

4.5

5.6

Property

4.5

5.6

Cash

2.0

2.3

Annuities

3.2

4.2

Expected rates of return are after deducting an allowance for the Scheme’s expenses.

Sensitivity to the actuarial assumptions:

Assumption

Change in assumption

Impact on scheme liabilities

Discount rate

Increase/decrease by 0.5%

Decrease/increase by 8%

Retail price inflation

Increase/decrease by 0.5%

Increase/decrease by 9%

Life expectancy

Increase/decrease by one year

Increase/decrease by 4%

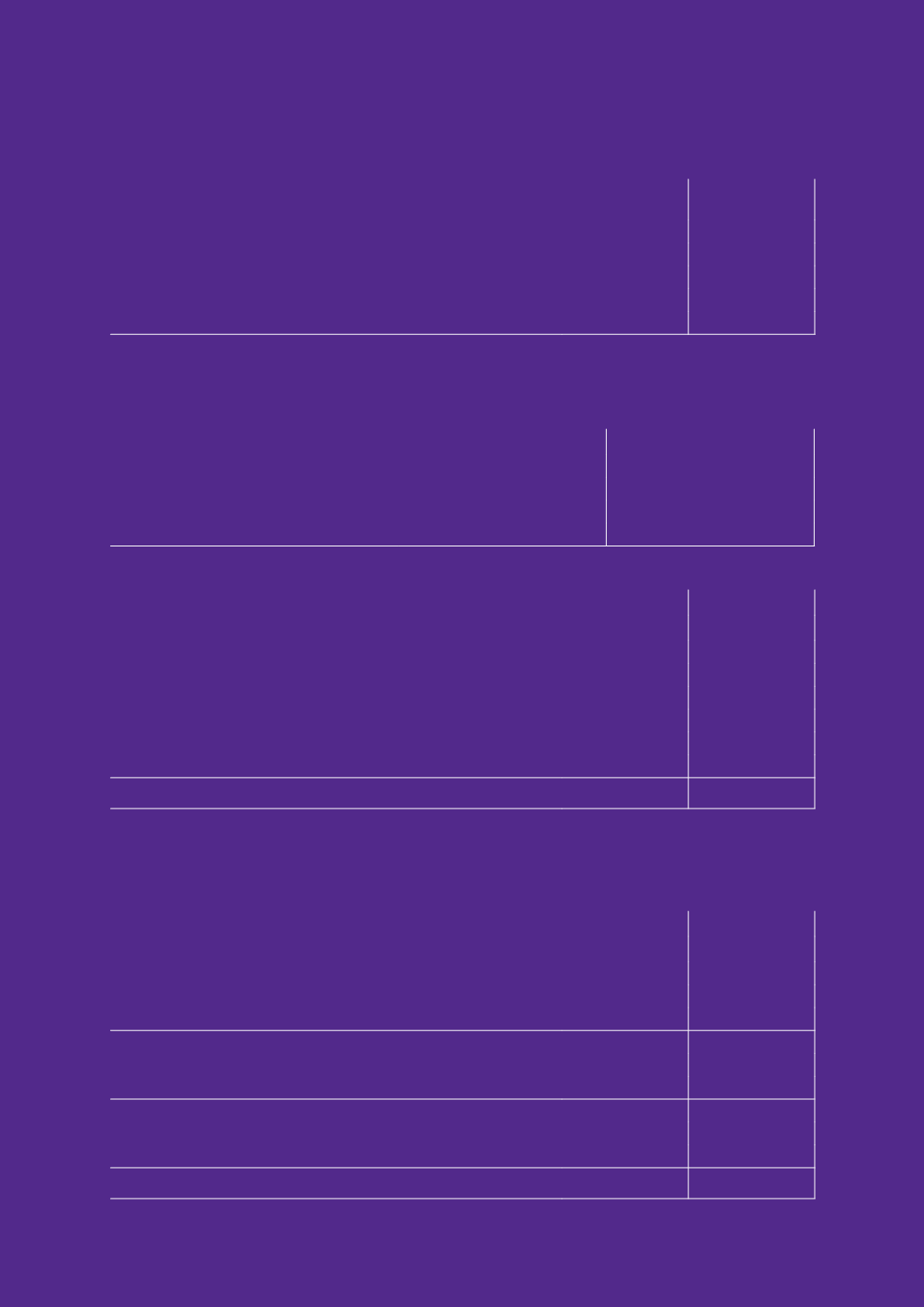

Breakdown of fair value of scheme assets:

Other assumptions:

2013

2012

£’000

£’000

Bonds

3,080

2,887

Equities

2,852

2,600

Property

347

373

Cash

122

95

Annuities

4,393

3,505

10,794

9,460

The scheme has no investments in any financial instruments issued by, or any property owned by,

the Wildfowl & Wetlands Trust.

Amounts recognised in the Balance Sheet:

2013

2012

£’000

£’000

Present value of funded obligations

13,214

9,981

Fair value of scheme assets

(10,794)

(9,460)

2,420

521

Present value of unfunded obligations

-

-

Unrecognised past service cost

-

-

2,420

521

Asset not recoverable through future contributions

n/a

n/a

Deficit

2,420

521

27. Pension commitments (continued)