50

WWT Report and Financial Statements 2012/13

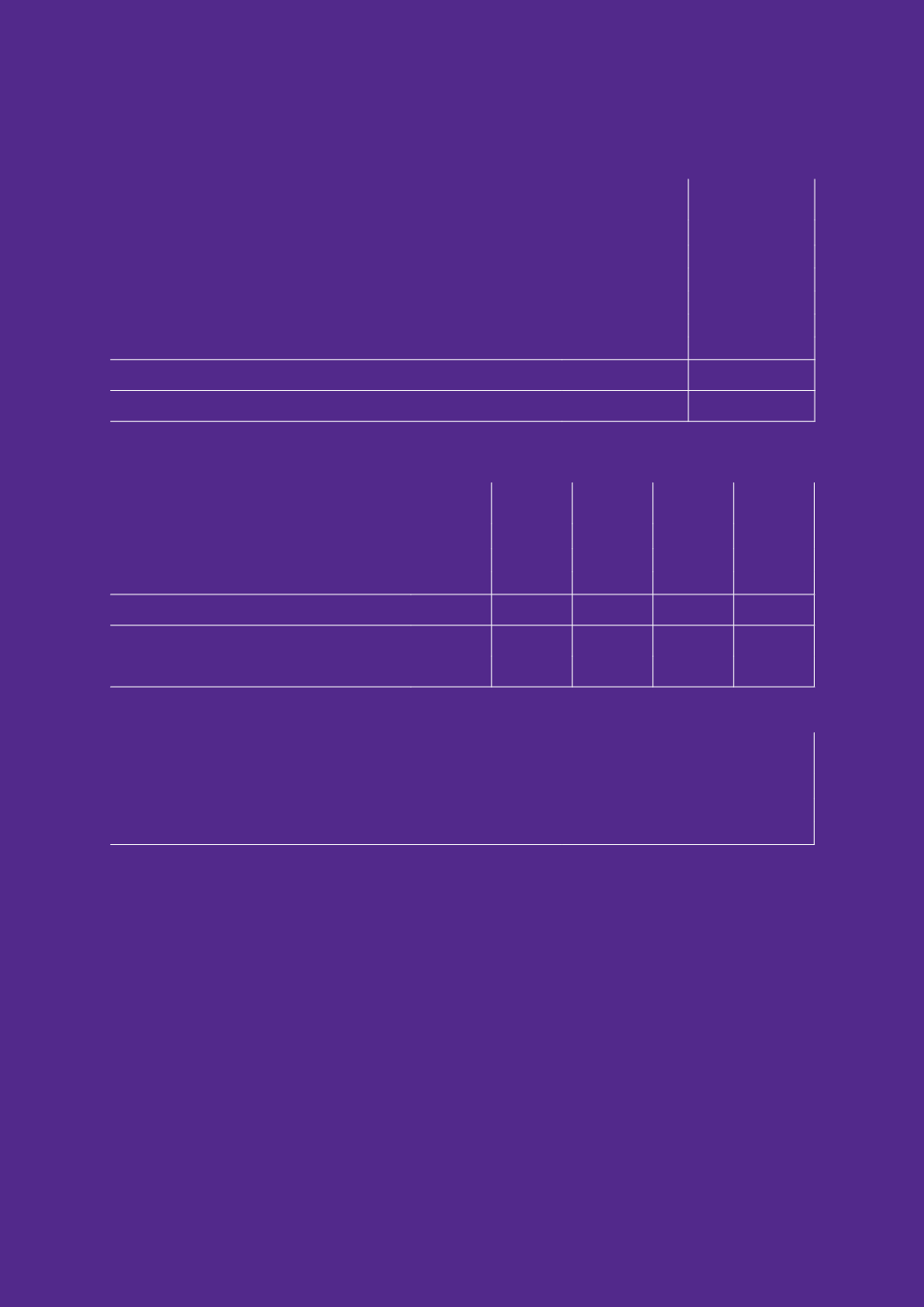

Change in fair value of scheme assets:

Other assumptions:

2013

£’000

2012

£’000

Opening fair value of scheme assets

9,460

9,111

Expected return on scheme assets, net of expenses

418

501

Actuarial gain/(loss)

992

7

Contributions by the employer

255

255

Benefits paid

(331)

(414)

Closing fair value of scheme assets

10,794

9,460

Actual return on scheme assets

1,410

508

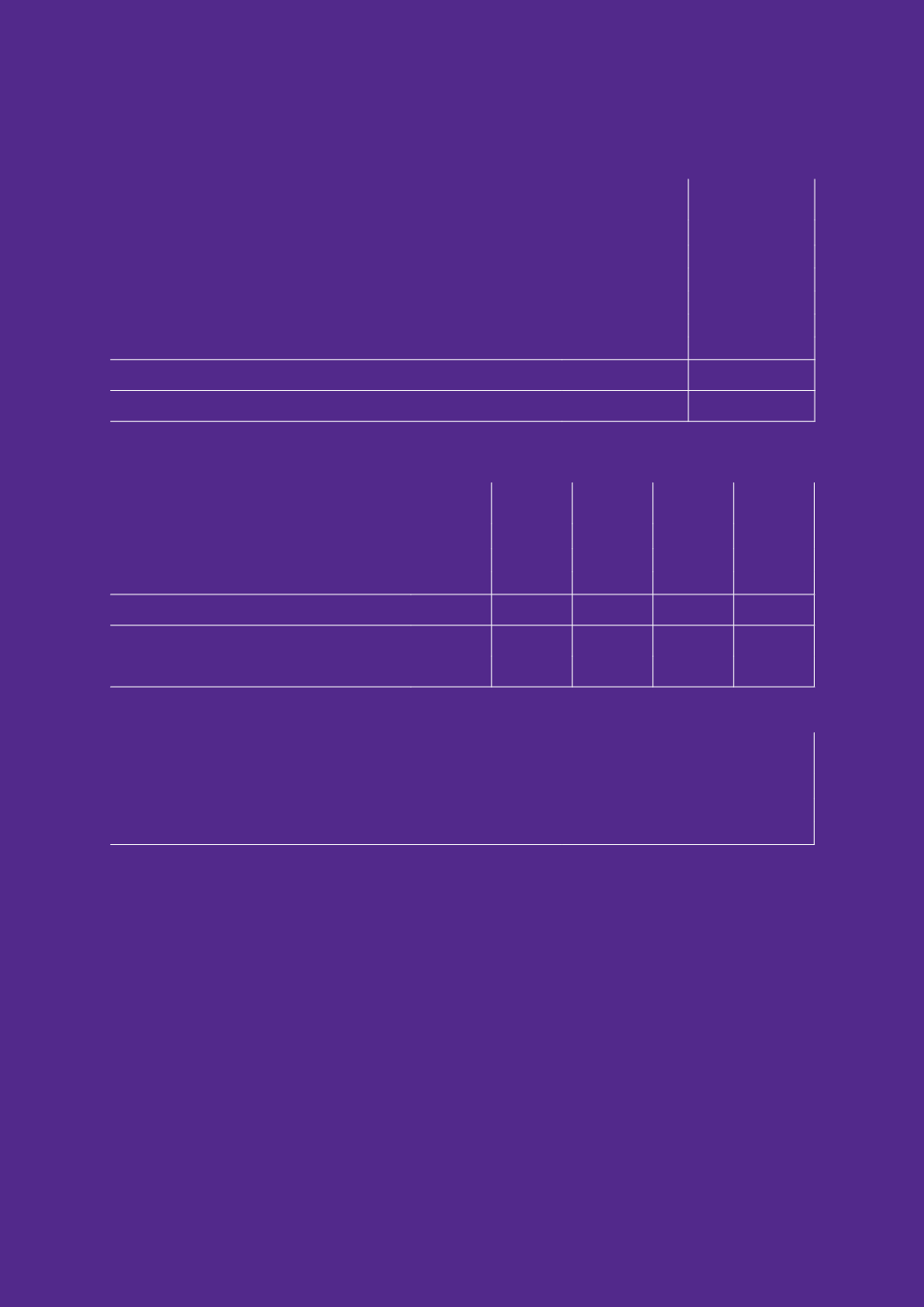

History of amounts for current and previous four accounting periods:

2013

£’000

2012

£’000

2011

£’000

2009

£’000

2008

£’000

Scheme liabilities

(13,214)

(9,981)

(9,281)

(9,453)

(6,352)

Scheme assets

10,794

9,460

9,111

8,315

7,290

(Deficit)/surplus

(2,420)

(521)

(170)

(1,138)

938

Experience adjustments on scheme liabilities

(454)

-

304 (2,845)

2,058

Experience adjustments on scheme assets

992

7

260

678 (1,700)

All of the surplus/deficit figures shown above are attributable to the employer rather than the scheme participants.

Expected contributions for next accounting period:

£’000

Expected contributions by the employer

255

Expected contributions by scheme participants

-

The contributions are determined by regular actuarial valuations of the Scheme under the Scheme Funding regime

prescribed by the Pensions Act 2004. The assumptions underlying these valuations, in particular the discount rate, are

derived using a different methodology to that used for the purposes of FRS 17.

The contributions payable by the employer under the Scheme’s current Schedule of Contributions to meet the scheme

funding deficit are £255k per annum until 31 March 2014, then £275k for the following 19 years.

(b) Defined contribution schemes

From 1 April 1997, WWT contributed to a defined contribution Group Stakeholder Personal Pension Plan (GSPPP)

invested in Friends Provident, an ethical fund. The pension charge for the year was £232k (2011/12: £221k).

WWT also contributes to one other scheme that is a defined contribution scheme. The assets of the scheme are held

separately from those of WWT in independently administered funds. The pension charge for these funds was £5k

(2011/12: £5k).

Included within Other Creditors are outstanding contributions of £38k (2012: £33k).

27. Pension commitments (continued)