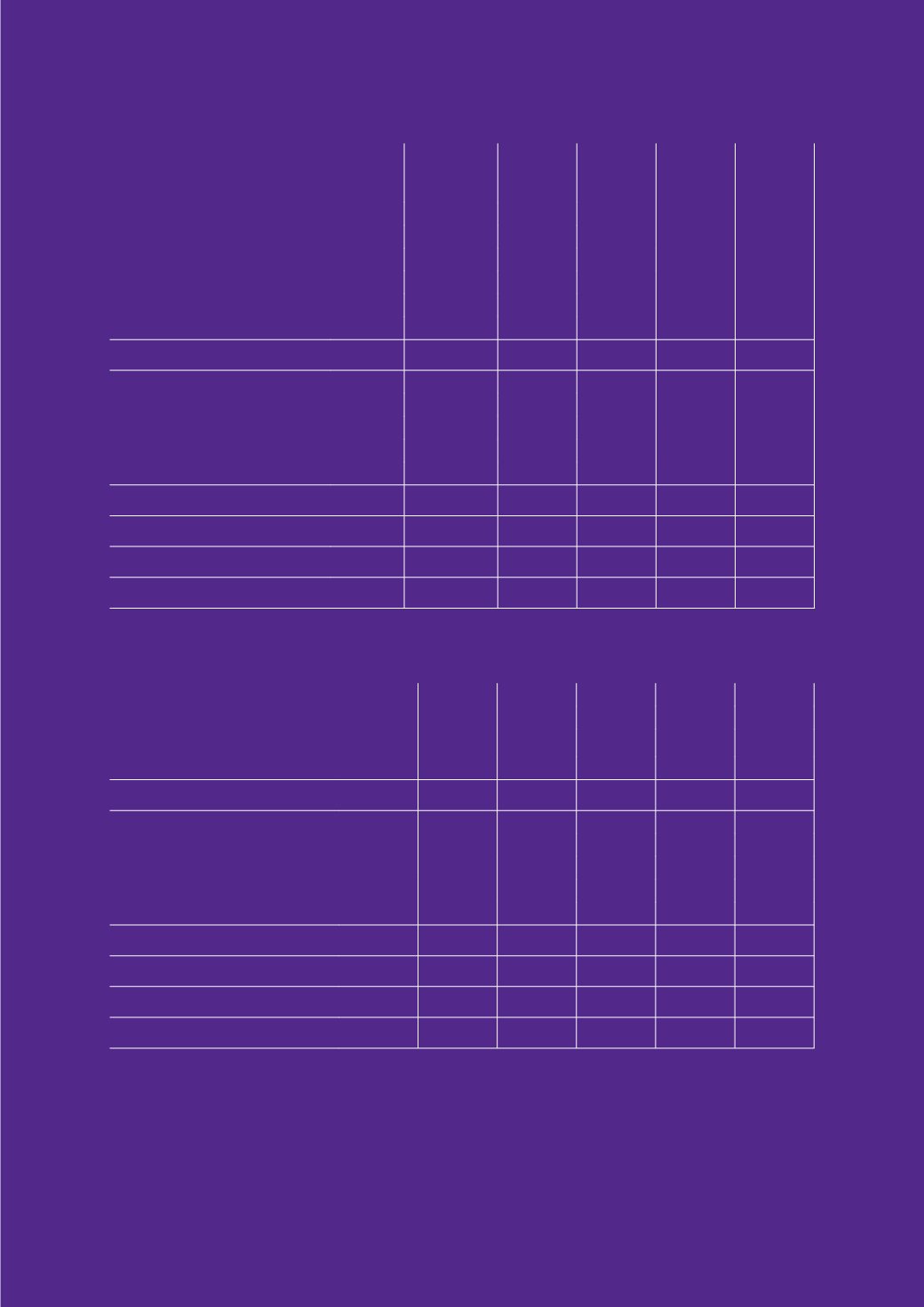

41

WWT Report and Financial Statements 2012/13

Land and

Buildings

£’000

In

Development

£’000

Plant and

Machinery

£’000

Motor

Vehicles

£’000

Computer

Equipment

£’000

Total

£’000

Group

Cost

At 31 March 2012

22,866

227

8,236

393

1,528 33,250

Additions

451

72

454

6

85

1,068

Disposals

(21)

-

(32)

(24)

-

(77)

Transfers

152

(152)

-

-

-

-

At 31 March 2013

23,448

147

8,658

375

1,613 34,241

Accumulated depreciation

At 31 March 2012

5,390

-

6,145

342

1,277 13,154

Charge for year

764

-

473

20

74

1,331

Disposals

(11)

-

(28)

(24)

-

(63)

At 31 March 2013

6,143

-

6,590

338

1,351 14,422

Net book value

At 31 March 2013

17,305

147

2,068

37

262 19,819

At 31 March 2012

17,476

227

2,091

51

251 20,096

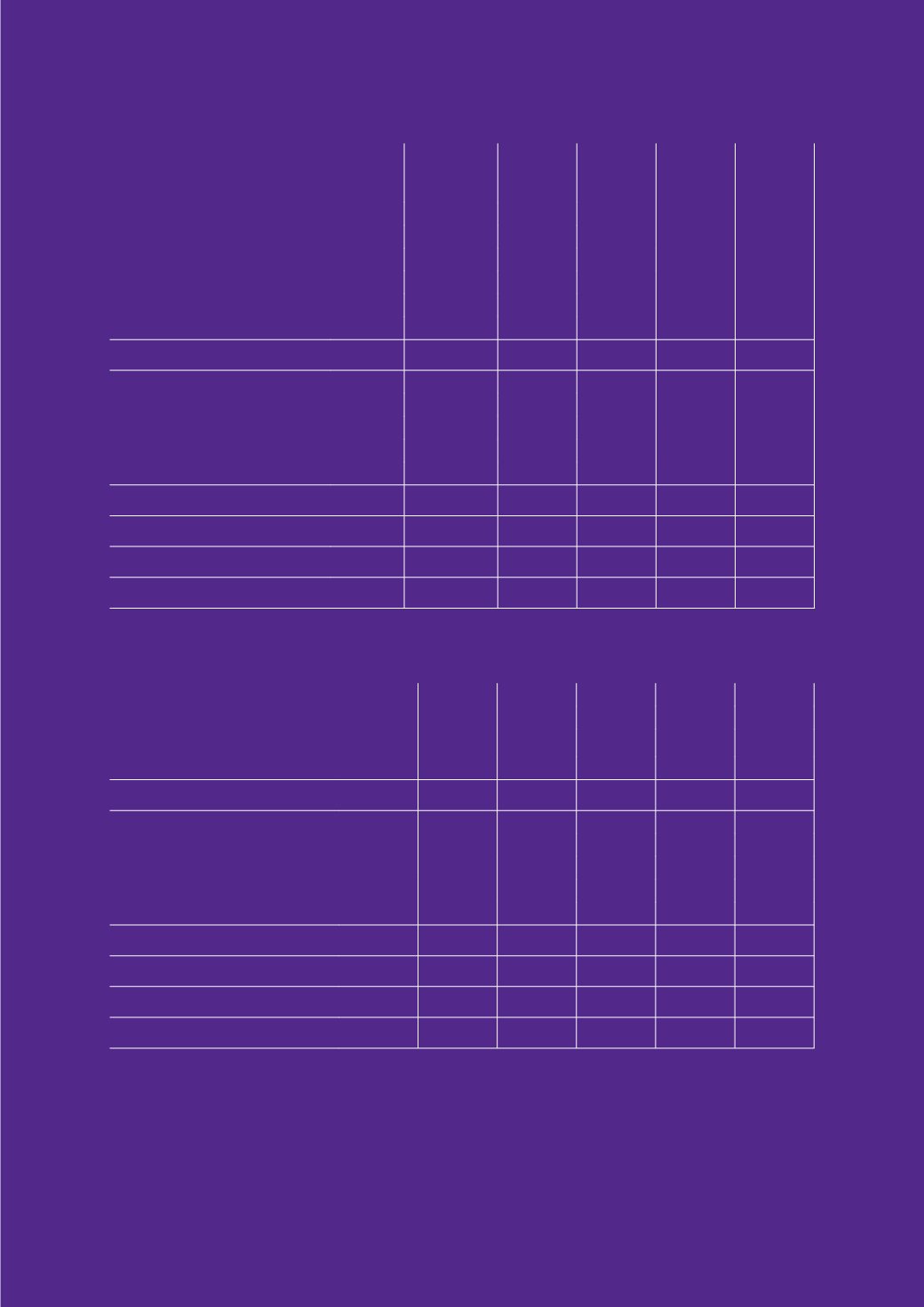

Charity

Cost

At 31 March 2012

22,866

227

7,607

393

1,259 32,352

Additions

451

72

333

6

85

947

Disposals

(21)

-

(30)

(24)

-

(75)

Transfers

152

(152)

-

-

-

-

At 31 March 2013

23,448

147

7,910

375

1,344 33,224

Accumulated depreciation

At 31 March 2012

5,390

-

5,731

342

1,057 12,520

Charge for year

764

-

400

20

60

1,244

Disposals

(11)

-

(25)

(24)

-

(60)

At 31 March 2013

6,143

-

6,106

338

1,117 13,704

Net book value

At 31 March 2013

17,305

147

1,804

37

227 19,520

At 31 March 2012

17,476

227

1,876

51

202 19,832

19. Tangible fixed assets

As at 31 March 2013 the group and charity net book value of assets held under finance leases amounted to £nil

(2011/12: £2k) and depreciation charged in the year includes £2k (2011/12: £12k) with respect to these assets.

The charity’s land and buildings recorded here are held by Wildfowl Trust (Holdings) Ltd, a wholly owned subsidiary of

the charity, which does not trade but acts as trustee of property for WWT.